the tax shelter aspect of a real estate syndicate

Thus investors cannot deduct their real estate losses from income. California will maintain its.

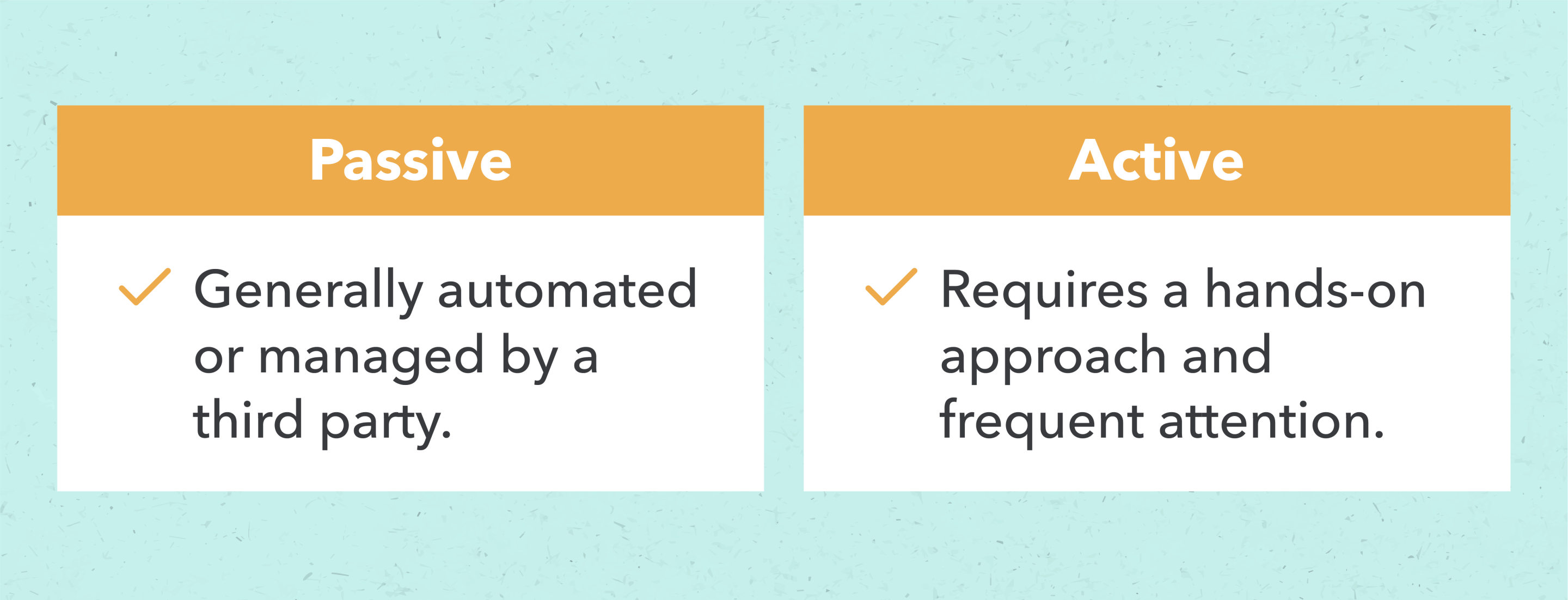

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

-- Boys Club Secures Site for Addition to Its Home -- Washington Heights Taxpayer Sold to Investor.

. The tax shelter aspect of real estate syndicates no longer exists. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. Philadelphia Syndicate Pays 1000000 for 750-Acre Tract at Wantagh LI.

Many people look to Real Estate Syndication for tax purposes. But the term tax shelter also includes syndicates. Three Common Tax Shelters in Real Estate.

Tion on Real Estate and its Recapture. The property tax is an ad valorem tax meaning that it is based on the value of real property. The main thing to remember is that the IRS taxes capital gains at a rate ranging somewhere.

Your business qualifies as a syndicate if more than 35 of its losses during the tax year are allocated to limited partners or. Between 0 and 20 compared to traditional income which is taxed between 10 and 37. Tax shelters can range from investments or.

Your business qualifies as a. In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

Your CPA or Tax advisor is the best person to. The concern said limited partnership interests in the property would be offered to the public- View Full Article in Timesmachine. Resolving Problems Raised by the 1969 Act 29 NYU.

Property taxes are based on the value of real property. Resolving Problems Raised by the 1969 Act 29 NYU. Reform of Real Estate Tax Shelters 7 U.

The tax shelter aspect of real estate syndicates no longer exists. Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. They have passive activity gains and need a shelter.

LI has by Windsor Securities Inc a real estate syndicate.

How Real Estate Syndication Is Answer For Income Problem

Real Estate Investors And Taxes Goodegg Investments

Compelling Tax Benefits Of Real Estate Syndication

Real Estate Syndication Structure For A Physician Investor

Real Estate Principles And Practices Chapter 16 Investment And Tax Aspects Of Ownership C 2014 Oncourse Learning Ppt Download

Commercial Real Estate Syndication Ultimate Success Guide

Basics Of Leading Real Estate Syndications Semi Retired Md

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

Ab Commercial Real Estate Private Debt Fund Llc

The Case For Private Real Estate White Coat Investor

A Peek Into The Projected Returns In A Real Estate Syndication

New Shakeout In Real Estate Syndicates The New York Times

Real Estate Syndication For A Physician Investor Physicianestate

Insight In The Beginning Was The Reit

Cash Flow Appreciation Or Tax Shelter What Are Your Goals For Investing In Real Estate Syndications Smart Capital Llc

What Is Real Estate Syndication Abcs Of Real Estate Syndication Investments For A Physician Investor

6 Tax Benefits Of Investing In Real Estate Syndications

How To Become A General Partner In A Real Estate Syndication Semi Retired Md

Passive Real Estate Investing Earn Passive Income Intuit Mint